What Are The 2025 Income Tax Brackets. These rates apply to your taxable income. These brackets apply to federal income tax returns you would normally file.

10 percent, 12 percent, 22 percent, 24. Credits, deductions and income reported on other forms or schedules.

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, For tax year 2025, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses: Below, cnbc select breaks down the updated tax brackets for 2025 and.

Az Tax Brackets 2025 Arlena Olivia, There are seven (7) tax rates in 2025. Credits, deductions and income reported on other forms or schedules.

Here are the federal tax brackets for 2025 vs. 2025, Your taxable income is your income after various deductions, credits, and exemptions have been. Features 2025 and 2025 tax brackets and federal income tax rates.

Tax Rates 2025 To 2025 2025 Printable Calendar, Singapore residents income tax tables in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Importantly, your highest tax bracket doesn’t reflect how much you pay on all of your.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, Canada 2025 and 2025 tax rates & tax brackets. Importantly, your highest tax bracket doesn’t reflect how much you pay on all of your.

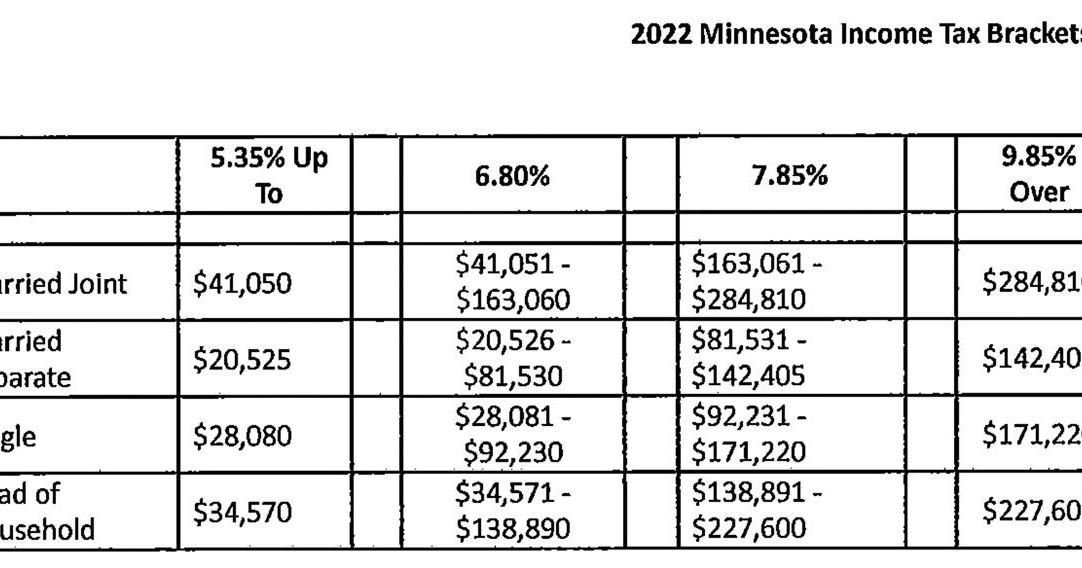

Minnesota tax brackets, standard deduction and dependent, Income tax bands are different if you live in. These rates apply to your taxable income.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Income tax rates and bands. The federal income tax has seven tax rates in 2025:

2025 Tax Brackets The Best To Live A Great Life, Below, cnbc select breaks down the updated tax brackets for 2025 and. The table shows the tax rates you pay in each band if you have a standard personal allowance of £12,570.

Nebraska Tax Brackets 2025, Tax brackets and tax rates. The table shows the tax rates you pay in each band if you have a standard personal allowance of £12,570.

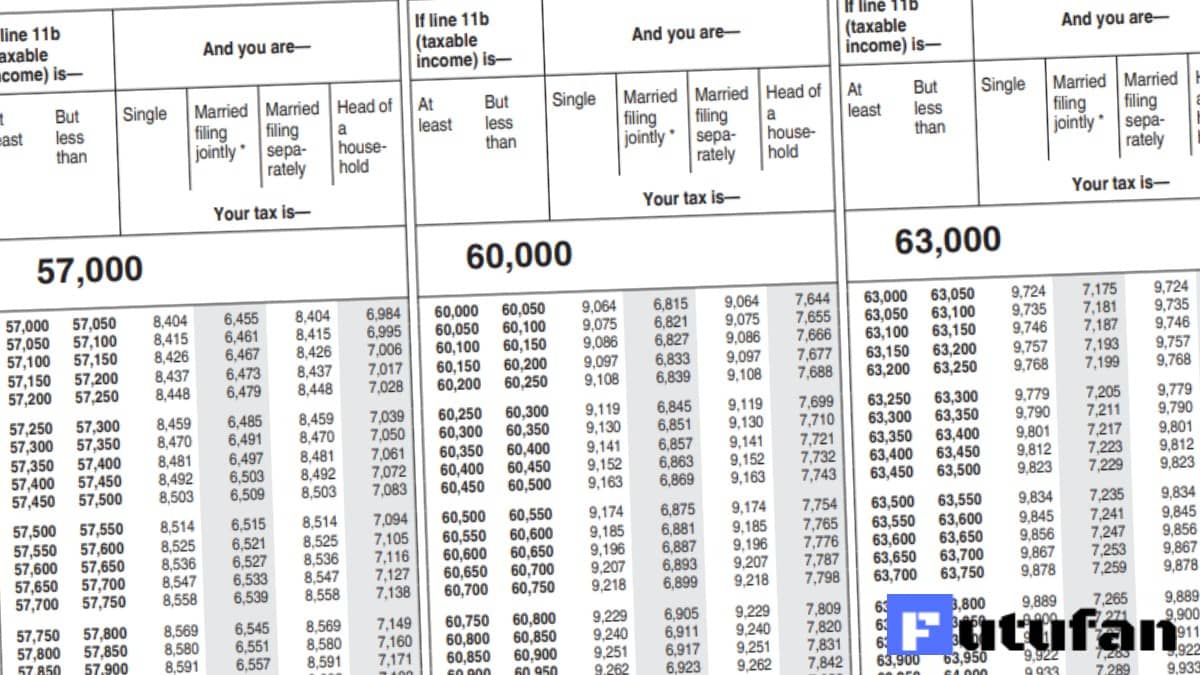

IRS Tax Tables 2025 Tax Tables Federal Federal Withholding Tables 2025, Features 2025 and 2025 tax brackets and federal income tax rates. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.